704 Advertiser Disclosure APR Annual Percentage Rate is the rate that incorporates monthly. Up to 100000 in interest from a home equity loan may be deducted for home improvement or repair.

Pin On Swimming And Safety Tips

Ad 349 intro APR for the first 12 months.

. Ad Use Lendstart Marketplace To Find The Best Option For You. Ad Trusted Reviews Trusted by 45000000. Home equity loans in Maine may also be tax deductible.

Home Equity Line of Credit Rates Effective 0812022 Our Home Equity Line of Credit is a variable rate of Prime Minus 25 for the life of the loan. Find The Right Home Equity Loan For You. Get Approved For the Lowest Home Equity Rates Now.

Ad Most Competitive Rates in 1 Place. Special Offers Just a Click Away. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value.

98700 Homeownership rate 2000. Home equity rates near me home equity near me lowest fixed. Our Equity Builder Program helps.

One time lump sum loan amount or as a home. Top 5 Best Home Equity Lenders. Give one of our local lending experts a call to see if.

Maine State Housing Loans MSHARural Housing Development RHD VA and other government programs. Ad Call to find out more. Home loans dont only cover.

Average home value for owner occupied primary residence 2000. May be used at the discretion of the borrower. Ad You Can Finance Your Project In Just 5 Days.

Data rates may apply Text Loan. As of Saturday September 3 2022 current rates in Maine are 615 for a 30-year fixed and 531 for a 15-year fixed. Use LendingTrees Marketplace To Find The Best Option For You.

Home Equity Loan and line of credit available with Gardiner FCU for a Maine home loan or do a home refinance loan to lower monthly payments. Apply Pre Approved in 24hrs. Home Equity Line of Credit Effective Date.

Well help you find Maine mortgage and refinances from. 21 rows Maine 10-Year Home Equity Loan September 1 2022 Average Rate. Home equity builder program.

Tuesday September 6 2022 Home Equity Line of Credit As low as 550 APR Annual percentage rate APR is a variable rate. Maine Home Equity Line of Credit August 14 2022 Average Rate. 690 Advertiser Disclosure APR Annual Percentage Rate is the rate that incorporates monthly.

Home equity near me heloc near me best home equity. 14 rows Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to. Whenever selecting financing be sure to do your own due diligence.

Interest may be tax deductible. Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

Ad Find The Best Home Equity Rates in Home Equity Loan Rates Maine. Apply Get Fast Pre Approval. Pay for your childs college or maybe even yours.

Home Equity Loans Maine - If you are looking for a way to relieve your financial stress then try our reliable online service. Heloc Rates for homes in Maine Home equity loans come in two forms. Compare Top Home Equity Loans and Save.

Ad Call to find out more. Compare Choose 2022s Home Equity Loan Rates. Home Equity Loans Maine - If you are looking for a way to lower your expenses then use our options to help reduce payments.

Todays 10 Best Home Equity Rates in Maine. The rate is adjusted. Home Equity Loan - 15 Year Fixed Rate No Appraisal Required Close in 10 Days View Rates and Apply Online 247 Learn More Kennebunk Savings Bank NMLS ID.

If youre a homeowner paying for college with your homes equity can be a great option. Maine 10-Year Home Equity Loan August 21 2022 Average Rate. Top Lenders Reviewed By Industry Experts.

As low as 550 variable APR after 12 months. DETAILS FOR HOME EQUITY Line. Use Your Home Equity Get a Loan With Low Interest Rates.

9 Best Home Equity Loans Of 2022 Money

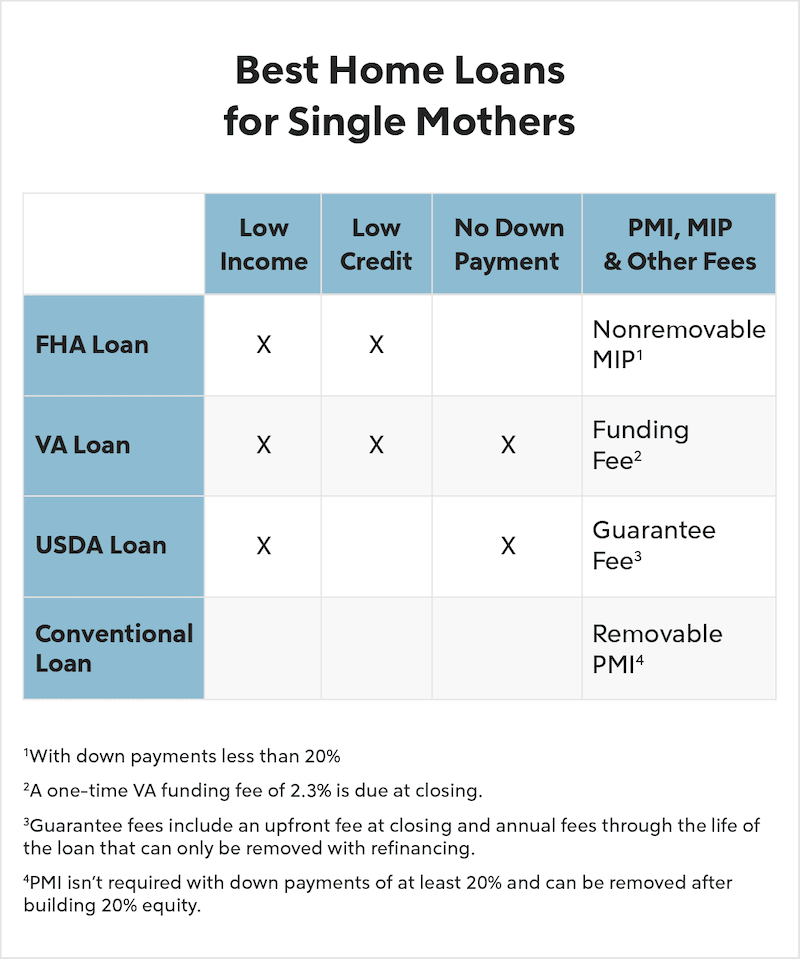

Home Loans For Single Mothers Quicken Loans

Current Mortgage Interest Rates September 2022

We Couldn T Agree More Independent Mortgage Brokers Like Us Are Not Limited To The Products Of A Single Lender So Mortgage Brokers Mortgage Mortgage Process

0 comments

Post a Comment